Denied Insurance Claims Attorney

Challenging Bad Faith Denials in Insurance Claims

Our San Francisco, CA denied insurance claim lawyer knows that insurance companies carefully craft denials of claims to provide the appearance of validity and to discourage the insured from making a fair and justifiable challenge. However, when you put the insurer’s denial under the microscope, the denial often cannot be sustained.

When properly challenged, the insurer’s highly selective “review” of the medical and vocational evidence can be readily exposed. The medical and vocational “experts” whom, you are told in the insurer’s denial letter, support the denial are often revealed to be mere pawns of the insurer with whom they enjoy a longstanding and highly lucrative business relationship.

Many Insurance Companies Manufacture Pretexts To Deny Claims

Under California law, your insurance company must thoroughly investigate any basis that may support payment of your claim and cannot disregard evidence that supports your claim. However, insurance companies create pretexts to deny claims including, most commonly:

- You have “no objective signs” or “no abnormality on exam” — even where your purported lack of objective signs or abnormality is irrelevant to why you are unable to work;

- You are able to engage in “sedentary work” — even where your ability to sit has nothing whatsoever to do with why you are disabled from your job;

- You fail to meet the “definition of disability” in the policy — even though the definition of disability in the policy, in fact, is illegal under California law;

- Your own treating doctor has stated that you are able to work — where, however, your treating doctor was never informed of the correct definition of disability under California law and obviously an incorrect definition in mind;

- Your own treating doctor does not support your inability to work — where, in fact, your doctor made an ambiguous statement about your working capacity that should and can easily be clarified — but your insurer elects not to do so and resolves the ambiguity in its favor.

When it comes to medical insurance, insurers commonly misconstrue key terms of the insurance policy such as “medical necessity” or “emergency care” to generate or buttress their denial of benefits. Medical insurers commonly assert inapplicable exclusions to deny your claim.

Bennett M. Cohen stands up for people whose insurance claim has been denied in bad faith. He will fight aggressively and effectively for you to recover the benefits you deserve.

What Are My Options If My Claim Has Been Denied?

If your insurance company has denied your claim or underpaid your claim, it is important that you seek counsel from an experienced insurance attorney. Once you know your rights under the law, you will be empowered to make the right decisions to obtain redress against the insurer.

At The Law Offices of Bennett M. Cohen, P.C. we represent individuals throughout California who have had their claims denied or benefits underpaid. Our San Francisco denied insurance claim lawyer has decades of experience successfully advocating for individuals whose benefits were unfairly denied due to the bad faith of insurers.

Understanding Health Insurance Claim Denials

If you have had a health insurance claim denied by an insurance company, a San Francisco, CA health insurance claim denial lawyer can help you. Health insurance is a critical safety net that provides financial protection when medical needs arise. It’s an assurance that, should health concerns emerge, financial coverage will be available. However, not all insurance claims are straightforward. Sometimes, insurance companies deny claims, leaving individuals grappling with medical bills they believed would be covered. These denials can arise from various reasons, such as discrepancies in paperwork, perceived non-covered treatments, or disagreements regarding the necessity of a medical procedure. No matter the circumstance of your claim denial, contact The Law Office of Bennett M. Cohen today to find out how we can help you with your claim.

The Importance Of Legal Representation

When facing a denied health insurance claim, the situation can seem daunting and, often, unfair. This is where a skilled San Francisco health insurance claim denial lawyer comes into the picture. Armed with the legal knowledge, experience, and a deep understanding of the intricacies of health insurance policies, a specialized lawyer can significantly increase the chances of overturning an unjust claim denial.

With a comprehensive approach that involves thoroughly reviewing insurance policies, evaluating the reasons for claim denials, and understanding the medical background of each case, having a good lawyer by your side ensures that every angle is covered.

The Role Of A Health Insurance Claim Denial Lawyer

The primary responsibility of a San Francisco health insurance claim denial lawyer is to serve as a bridge between the claimant and the insurance company. They analyze the cause of the denial and determine if it’s grounded in the terms of the policy or if there might be an overreach on the part of the insurer.

This process involves gathering information, policy review, negotiation, and, if necessary, litigation. Gathering information is the foundational step where all relevant documents, including medical records and correspondence with the insurer, are compiled. Policy review entails a meticulous analysis of the health insurance policy helps to understand its terms, conditions, and any fine print that might be relevant to the claim. Often, claim denials can be resolved without litigation. A seasoned health insurance claim denial lawyer can engage in negotiations with the insurance company, aiming to secure a fair settlement. In cases where a resolution cannot be reached through negotiation, the next step is to present the case in court. With a robust legal strategy and compelling evidence, a claim denial can be contested effectively.

Moving Forward With Confidence

Encountering a health insurance claim denial can be stressful and, for many, financially crippling. However, it’s essential to remember that a denial is not the end of the road. With the right legal representation, there’s a substantial possibility of overturning the decision and securing the benefits one is entitled to.

If you or someone you know is facing challenges with a denied health insurance claim, let the experienced team at The Law Office of Bennett M. Cohen support you through the process.

Steps After Health Insurance Claim Rejection

If you need medical coverage for an accident or injury but your insurance company isn’t paying up, your San Francisco, CA health insurance claim denial lawyer can help. At The Law Office of Bennett M. Cohen, our team provides over 30 years of litigation experience (including representing plaintiffs against major corporations like Shell Oil). Now, we’re ready to use our experience to help you get the coverage you deserve. Read on to see your next steps after a claim denial, and contact us today to get started.

- Review the Rejection Letter Carefully

Start by thoroughly reading the rejection letter. It usually explains why your claim was not approved. Look for any mention of missing information, errors in the claim form, or uncovered services. Understanding the reason for the rejection is the first step in determining how to respond.

- Gather Your Documents

Collect all relevant documents related to your claim. This includes your insurance policy, any correspondence with your insurance company, medical records, and receipts. Having all your documents organized will help you when you need to discuss the case with your insurance company or seek further assistance.

- Contact Your Insurance Company

Reach out to your insurance company for clarification on why your claim was rejected. Sometimes, a simple error in the paperwork or a misunderstanding about your coverage can be quickly resolved over the phone.

- Submit an Appeal

If the rejection is due to a more complex issue, consider filing a formal appeal. Check your insurance policy for the appeal process guidelines. Submitting a well-organized appeal that addresses the specific reasons your claim was denied increases your chances of overturning the decision.

- Seek Assistance

Sometimes, you might feel overwhelmed by the appeal process or the reasons for the claim denial might be too complex to tackle alone. This is when getting help can make a difference. Reach out to healthcare providers for support with medical information, or consider contacting a legal professional who understands the subtleties of insurance law and can offer you guidance.

- Follow Up Regularly

After submitting an appeal, keep track of its progress. Don’t hesitate to follow up with your insurance company regularly to check on the status of your appeal. Keeping the lines of communication open is important.

- Know Your Rights

Understanding your rights under your insurance policy and your legal rights under state laws can empower you. Knowledge about these rights can provide a solid foundation if you need to escalate your appeal. Fortunately, your San Francisco insurance claim denial lawyer can explain your rights and your next course of action.

- Prepare for Future Claims

To avoid future rejections, review your policy to understand what is covered and what is not. Adjust your policy if needed to better meet your health care needs. Make sure to fill out claim forms accurately and provide all required documentation promptly.

Contact Us Today

Dealing with a rejected health insurance claim can be challenging, but you’re not alone. At The Law Office of Bennett M. Cohen, we’re here to support you through this process. If you find the task daunting or if your appeal has been denied, don’t hesitate to reach out for help. Our team is here to provide the guidance you need. Contact us today, and see what a San Francisco health insurance claim denial lawyer from our office can do for you.

San Francisco Health Insurance Claim Denial Infographic

San Francisco Health Insurance Claim Denial Statistics

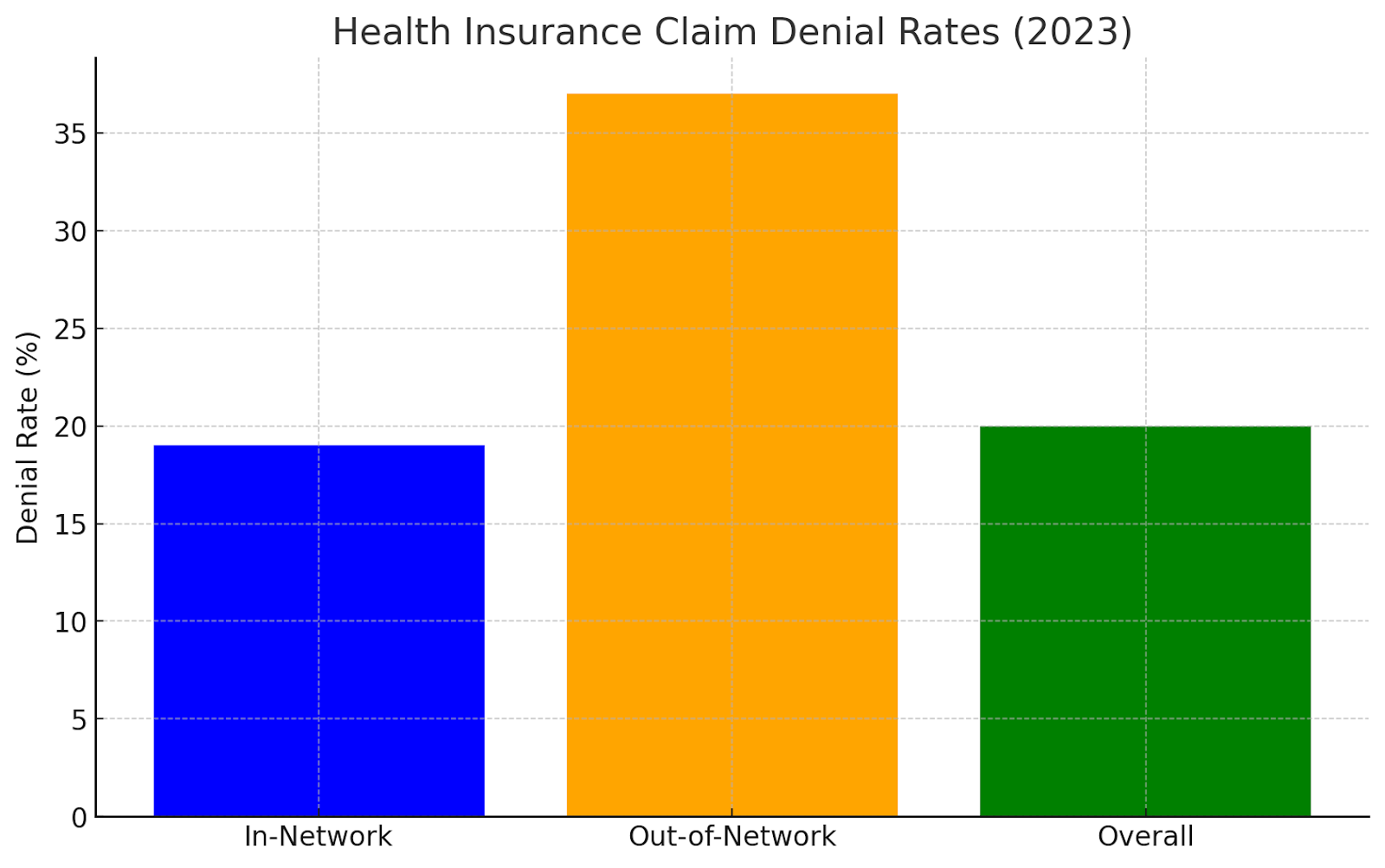

Health insurance claim denials remain a significant concern for consumers navigating the U.S. healthcare system. In 2023, insurers offering qualified health plans (QHPs) on HealthCare.gov denied approximately 19% of in-network claims and a higher 37% of out-of-network claims, culminating in an overall denial rate of 20% for all claims.

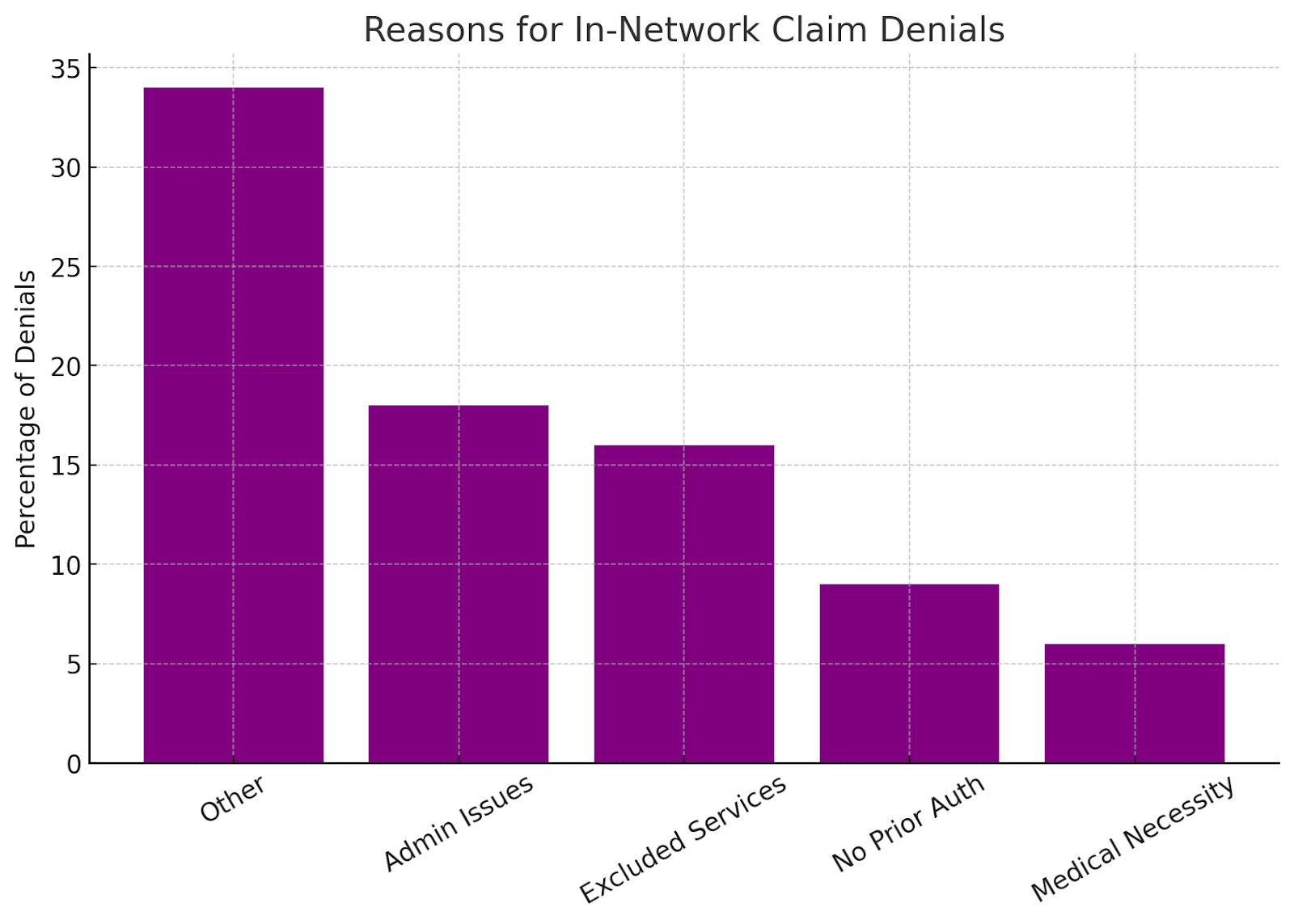

The reasons for these denials are varied. Among in-network claim denials, 34% were attributed to unspecified “other” reasons, 18% to administrative issues such as missing information, 16% to excluded services, 9% due to lack of prior authorization or referral, and only 6% were based on medical necessity.

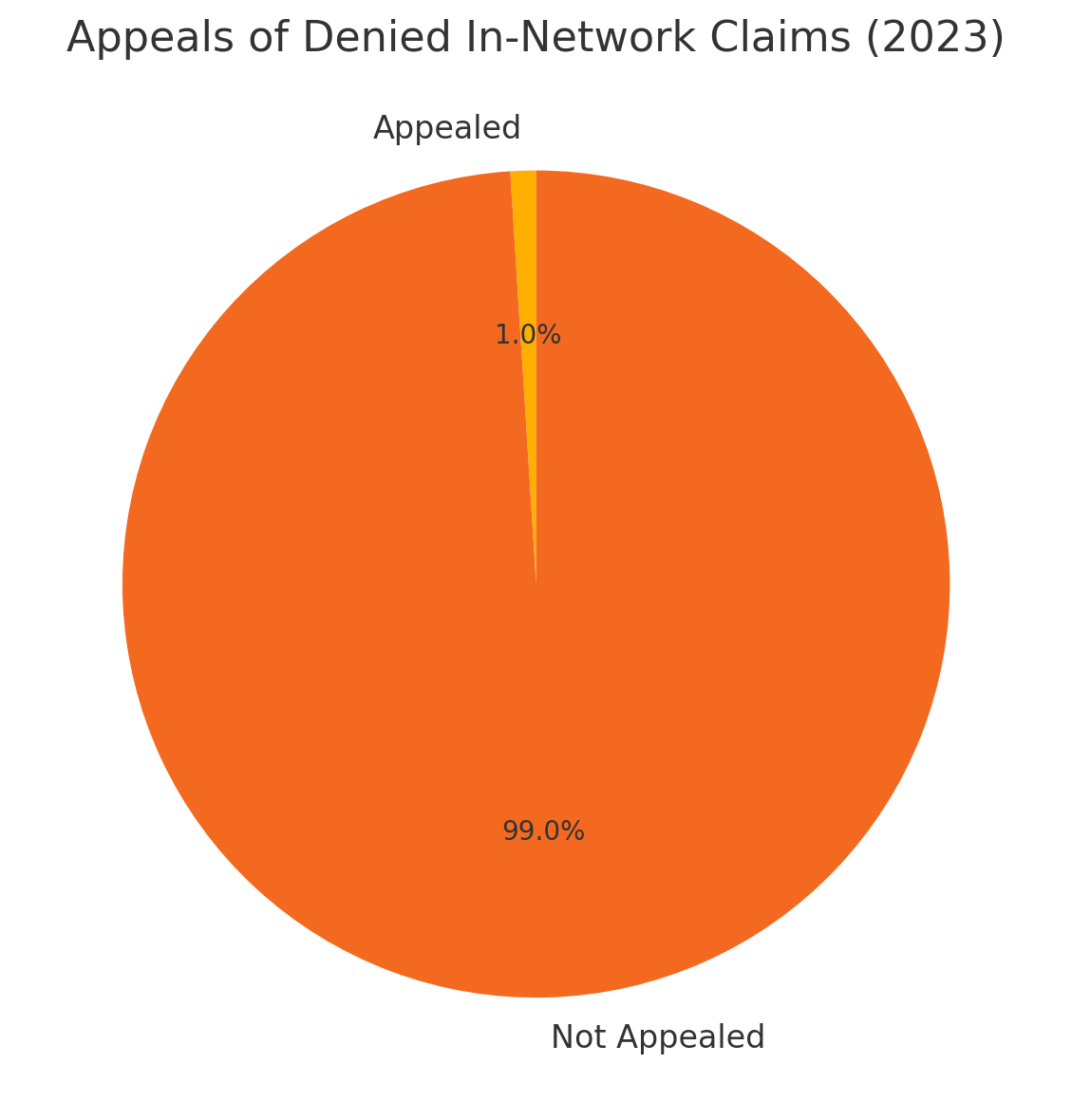

Despite the prevalence of claim denials, consumer appeals are notably rare. In 2023, less than 1% of denied in-network claims were appealed. Of these appeals, insurers upheld their original denial decisions in 56% of cases.

These statistics underscore the challenges consumers face in obtaining coverage for healthcare services and highlight the importance of understanding the appeals process.

San Francisco Health Insurance Claim Denial FAQs

If your insurance provider isn’t respecting your claim, your San Francisco, CA health insurance claim denial lawyer can help you fight for the compensation you deserve. At The Law Office of Bennett M. Cohen, we’ve helped our clients with disability and insurance cases, and we’re ready to use our over 30 years of experience to help you next. Read on to get answers to common insurance questions, and contact us today to get started on your case.

What Is One Of The Most Common Reasons For A Claim Being Rejected By An Insurance Company?

One of the most frequent reasons claims are denied is because the insurance company determines the procedure or treatment is not medically necessary. Insurers rely on their own criteria, which may differ from a doctor’s recommendation, to assess necessity. Other common reasons include incomplete paperwork, lack of pre-authorization, or receiving care from out-of-network providers.

What Distinguishes An Internal Appeal From An External Review?

An internal appeal involves asking your insurance company to reconsider its decision. This process is handled within the insurance company itself and typically includes submitting additional information, such as medical records or letters from healthcare providers, to support your claim.

An external review, on the other hand, involves a neutral third party. If your internal appeal is unsuccessful, many states allow you to request an external review, where an independent reviewer examines the case and decides if the insurer’s decision should be overturned.

What Documentation Is Necessary When Disputing A Medical Claim Denial?

Accurate and thorough documentation is key when challenging a denied claim. Start with a copy of the denial letter, which explains why the claim was rejected. You’ll also want to gather relevant medical records, physician statements, and evidence that the treatment is covered under your policy. Get in touch with your SF insurance claim denial lawyer to make sure you aren’t missing any important paperwork.

How Long Does The Appeal Process Typically Take For A Denied Medical Claim?

The timeline for an appeal can vary depending on whether you’re pursuing an internal appeal, an external review, or both. Internal appeals often take 30 to 60 days, while external reviews may take longer, depending on the complexity of the case.

What Should I Anticipate During The Legal Proceedings For A Claim Denial?

If you decide to pursue legal action after exhausting the appeal options, the process typically begins with filing a formal complaint. This document outlines your case and the reasons you believe the insurance company acted unfairly.

From there, both parties gather evidence to support their positions, which may include depositions, expert testimony, and document reviews. While many cases settle before trial, it’s important to prepare for the possibility of litigation. Throughout the process, we work closely with our clients to keep them informed and comfortable with each step.

We’re Here To Help

Addressing a denied medical claim can be a challenging process, but you don’t have to face it alone. At The Law Office of Bennett M. Cohen, we work with individuals to challenge unfair claim denials and fight for the coverage they deserve. If you need guidance, reach out to us today, and see what a San Francisco insurance claim denial lawyer from our office can do for you.

Health Insurance Claim Denial Glossary

At The Law Office of Bennett M. Cohen, we represent individuals across California who have been unfairly denied health insurance benefits. If you’re facing an unexpected denial, our San Francisco, CA health insurance claim denial lawyer from our firm is ready to assist you in evaluating your claim and pursuing the benefits you’re entitled to. Below are essential terms and legal phrases that often arise in health insurance denial cases. Understanding these can help clarify the legal processes involved when dealing with denied claims.

Bad Faith Denial

A bad faith denial happens when an insurance company intentionally delays, underpays, or denies a legitimate claim without a reasonable basis. Under California law, insurers are required to conduct a fair investigation and give equal consideration to evidence that supports payment of the claim. When they ignore supporting medical documentation or misinterpret policy terms to avoid payout, they may be held legally accountable for acting in bad faith. This type of denial can expose the insurer to additional penalties beyond just the value of the denied claim.

Medical Necessity

Medical necessity is a commonly disputed term used by insurers to justify health insurance claim denials. In many cases, the insurer will claim that a specific treatment, test, or procedure was not “medically necessary” as defined by their internal guidelines, even when a treating physician supports the treatment. This allows insurers to avoid coverage by substituting their judgment for that of the medical provider. Legal challenges to these denials often involve showing that the definition of “medical necessity” used by the insurer is either too narrow or inconsistent with California law.

Vocational Evidence

Vocational evidence refers to the analysis of an individual’s ability to perform their occupation or any other work, based on their education, experience, and medical limitations. Insurers frequently rely on their own vocational reviewers, who may downplay or misrepresent the claimant’s limitations to argue that they can still perform sedentary or alternative work. These opinions are often formed without a complete understanding of the insured’s real job duties or physical capabilities. Challenging this type of evidence is a key component in many disability and health insurance claim denial cases.

Definition Of Disability

The definition of disability in a health or disability insurance policy can significantly affect whether a claim is approved or denied. Some insurers use restrictive definitions that may not comply with California’s legal standards. For instance, they might define disability in a way that disqualifies individuals unless they are totally unable to perform any work at all—even though California courts have ruled such definitions illegal. A misrepresentation or misapplication of this term is one of the most common tactics used by insurers to deny valid claims.

Policy Exclusion

Policy exclusions are specific provisions in an insurance policy that outline treatments, conditions, or services that are not covered. Health insurers often invoke these exclusions to justify denial of benefits. However, they sometimes apply exclusions incorrectly or cite exclusions that don’t actually relate to the claim at hand. For example, an insurer might assert that a treatment falls under a cosmetic or experimental exclusion, even when the treatment is necessary and widely accepted in the medical community. It’s critical to analyze whether the exclusion is actually applicable under California insurance law.

Contact Our Law Firm

We offer free initial consultations for new clients and are happy to schedule meetings at a time that is convenient for you. Our San Fransisco denied insurance claim lawyer handles cases throughout the Bay Area and the surrounding regions of California. Call us, send us an email or use the inquiry box online. Our office is dedicated to providing timely and clear communication with our clients. When you contact The Law Offices of Bennett M. Cohen, P.C., you will receive straightforward responses and practical answers to your insurance questions.

Meet Bennett M. Cohen

San Francisco Personal Injury Attorney

Bennett M. Cohen brings over 30 years of litigation experience which includes representing plaintiffs against massive companies like the Shell Oil Company, Standard Insurance Company, and Metropolitan Life Insurance Company. Bennett M. Cohen brings an experienced and dynamic touch that separates himself from large law firms. He can oversee every aspect of your case, ensuring you receive specialized assistance.

Learn moreDon’t Leave Your Case To Chance

Ensure your case is in the hands of a seasoned professional that will fight for you