Insurance Policy Lawyer San Francisco, CA

Ready To Advocate For Your Best Result

If you find yourself in a dispute with your insurance provider, then our San Francisco, CA insurance policy lawyer can help you. These can be complicated issues, and having professional guidance and aid greatly increases your chances of reaching a favorable outcome. If you’re looking for legal representation in a life insurance dispute, let us be your advocate. We’ll provide the personal service and steadfast support you deserve. Contact The Law Office of Bennett M. Cohen today to schedule a free case evaluation.

Table Of Contents

- Ready To Advocate For Your Best Result

- How Our Insurance Lawyer Can Help You

- 10 Tips for Choosing the Right Insurance Policy

- San Francisco Insurance Policy Infographic

- San Francisco Insurance Policy Statistics

- San Francisco Insurance Policy FAQs

- San Francisco Insurance Policy Glossary

- The Law Office of Bennett M. Cohen, San Francisco Insurance Policy Lawyer

- Contact Our San Francisco Insurance Policy Lawyer Today

What To Know About Life Insurance Policy Disputes

While life insurance policies and claims may seem straightforward on the surface, there are a number of reasons why a dispute may arise between a policyholder and a provider or between multiple parties attempting to file a claim.

There may be disputes over multiple parties who claim to be the beneficiary of the policy or disagreements between primary and contingent beneficiaries. Disputes may also arise due to claims of policy exclusions or misrepresentation by the insurance provider, delayed or undervalued payments by the provider, or disagreements in interpretation of the policy between a claimant and the provider.

No matter the reason for the dispute, our attorney has experience handling insurance companies and knowledge helping our clients favorably settle such disputes. We understand tactics that insurance providers use to undervalue or deny claims, and are equipped to fight back in order to receive the full and fair amount that our client is owed.

In a life insurance policy dispute, or any insurance policy dispute, it is our insurance dispute lawyer’s job to do the difficult work of negotiating and presenting evidence on your behalf. Our team will review your policy, beneficiary designations, correspondence with the insurance company or other claimants, and any other documents that they believe are necessary to build your case. We will then gather evidence and negotiate on your behalf with the insurance provider and other claimants.

Beyond bringing experience and knowledge in such negotiations, our attorney serves as a personal advocate for you and your claim. We will fight to have your rights as a policyholder and claimant protected, and give you the peace of mind of knowing that your case is in good hands.

How Our Insurance Lawyer Can Help You

At The Law Office of Bennett M. Cohen, our San Francisco insurance policy lawyer is committed to effectively resolving insurance disputes and protecting the rights of our clients. With extensive experience in the field, we offer comprehensive legal support to our clients. We’ll deal with the insurance company and fight for the justice and compensation you deserve.

Understanding Insurance Law

Insurance law is multifaceted and varies significantly depending on the policy and the nature of the claim. Our adept insurance litigation lawyers stay abreast of the latest legal developments to provide informed guidance on personal and commercial insurance claims. We assist with a variety of insurance matters including property damage, business interruption, liability claims, and more. Our goal is to make sure that our clients’ policies work for them when they need it the most.

Insurance policies are contracts that promise coverage under specific circumstances. However, disputes often arise over the interpretation of policy language or the extent of the coverage provided. Our lawyer knows how to analyze the details of policy documents to advise our clients on their legal standing and the merits of their claims. Whether you’re facing a denial of a claim, undervaluation, bad faith case, or any other insurance-related issue, we’re equipped to handle it.

Strategic Legal Action For Policyholders

When disputes escalate, strategic legal action becomes necessary. An insurance policy specialist at our firm can represent you in negotiations with insurance companies and, if needed, litigation. Our firm leverages its deep understanding of insurance law combined with a strategic approach to litigation to advocate fiercely for our clients’ interests. Our determination and legal prowess mean we are consistently striving for the best possible outcomes for those we represent.

We understand that every insurance claim is unique and has specific challenges and requirements. Protecting your interests is our top priority, and we work diligently to craft a legal strategy that aligns with your specific circumstances. We aim to resolve disputes efficiently and effectively so that we can minimize the stress and financial impact on our clients.

10 Tips For Choosing The Right Insurance Policy

Choosing the right insurance policy can be a stressful process, and at The Law Office of Bennett M. Cohen, our San Francisco insurance policy lawyers understand the importance of making informed decisions to protect your interests. Here are our top 10 tips to guide you through the process of selecting the insurance policy that best suits your needs in San Francisco.

- Identify Your Coverage Requirements: Start by evaluating your specific needs. Consider factors such as your lifestyle, financial situation, and potential risks. This self-assessment will serve as the foundation for determining the type and amount of coverage you require.

- Compare Multiple Insurance Providers: Don’t settle for the first insurance provider you come across. Research and compare offerings from multiple providers to see you get the best coverage at the most reasonable rates. Look beyond the premiums and examine the overall value and reputation of the insurer.

- Educate Yourself On Different Coverage Options: Insurance policies come in various types, each catering to different needs. Understand the distinctions between policies such as liability, comprehensive, and umbrella coverage. This knowledge will empower you to make informed decisions aligned with your requirements.

- Find A Balance Between Premiums And Deductibles: Consider your budget and financial capabilities when determining the deductible amount. While higher deductibles can lead to lower premiums, you should strike a balance that prioritizes affordability in the event of a claim.

- Seek Adequate Protection: Review the coverage limits to make sure they align with your potential risks. Inadequate coverage may leave you vulnerable in the face of unexpected events. Assess your assets and liabilities to determine the appropriate coverage limits for your situation.

- Be Aware Of Policy Limitations: Carefully examine policy exclusions to understand situations or circumstances not covered by the insurance. Knowing these limitations allows you to plan for potential gaps in coverage and explore additional policies if needed. Our lawyer can assist with this too.

- Prioritize Responsive Insurers: Excellent customer service is paramount in times of need. Research customer reviews, testimonials, and complaints to gauge the responsiveness and reliability of the insurance provider’s support services.

- Review Policy Renewal Terms: Some policies may come with automatic renewals, while others may require a proactive approach. Familiarizing yourself with renewal procedures helps prevent lapses in coverage.

- Explore Discounts Through Package Deals: Explore the possibility of bundling multiple insurance policies with a single provider. Many insurers offer discounts when you bundle, such as combining auto and home insurance. This can lead to cost savings while simplifying your insurance management.

- Consult An Attorney: When in doubt, seek professional guidance. Our experienced team can provide valuable insights and help you understand complicated policy terms and legal implications.

We are dedicated to helping you make well-informed decisions regarding your insurance needs. If you find yourself facing challenges or uncertainties in selecting the right insurance policy, our firm is here to provide experienced guidance and steadfast support.

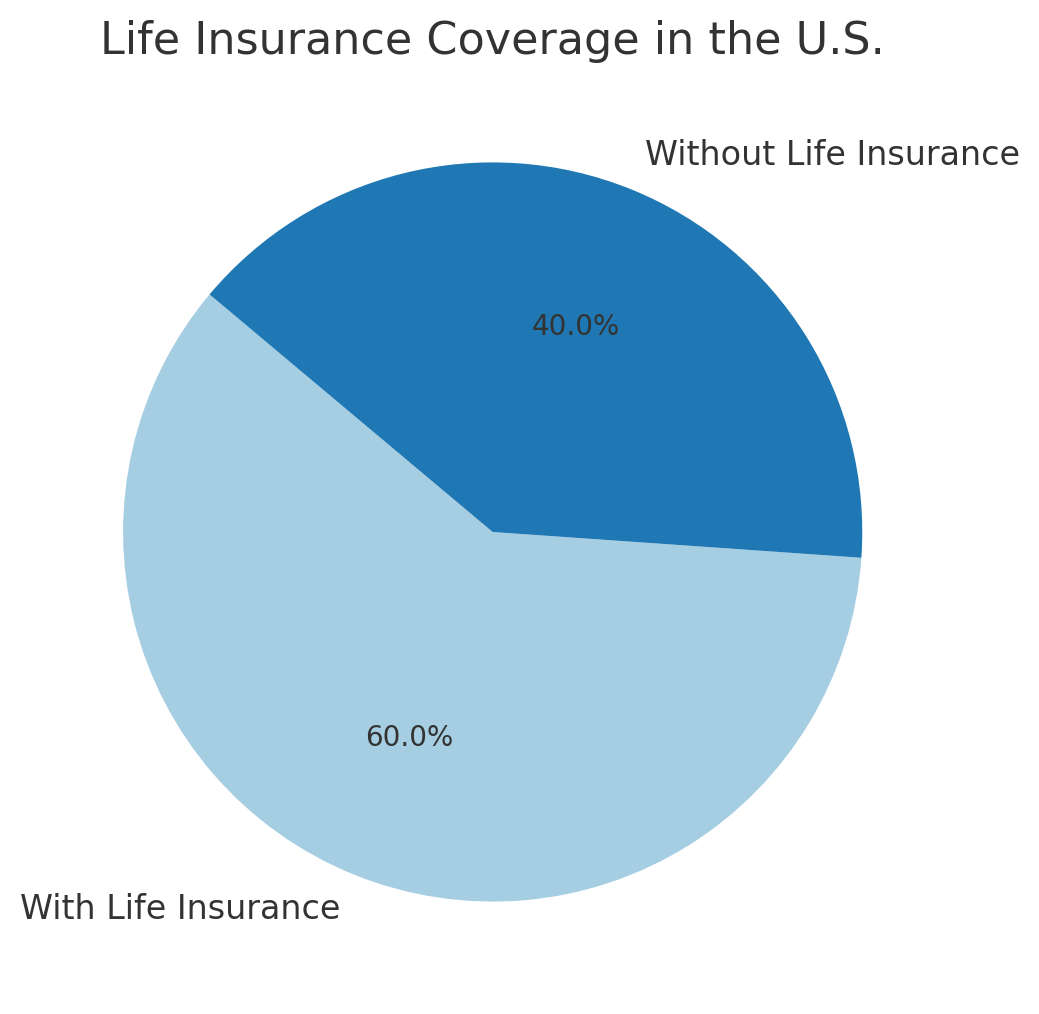

San Francisco Insurance Policy Infographic

San Francisco Insurance Policy Statistics

According to statistics from the Insurance Information Institute, approximately 60 percent of Americans have some type of life insurance, which amounts to about 267 million policies. Most people view life insurance as an income replacement for their families should anything happen to them. Unfortunately, not all insurance companies pay like they are supposed to. If you are having issues, contact our office to find out how we can help.

San Francisco Insurance Policy FAQs

If you have a legal issue with your insurance policy, you may want to consult our insurance companies attorney to address your questions and concerns. Here are some frequently asked questions we get from our Bay Area clients:

What Is An Insurance Policy Lawyer?

Our insurance policy lawyers are legal professionals who specializes in matters related to insurance policies. Our attorneys are skilled at interpreting, analyzing, and handling legal issues associated with insurance contracts and coverage.

Why Might I Need An Insurance Policy Lawyer?

You may require the services of our insurance policy attorney if you encounter disputes or challenges with your insurance coverage. Our legal professionals can assist in understanding high-level policy language, negotiating with insurers, and representing your interests in legal proceedings if necessary.

What Types Of Insurance Policies Do These Lawyers Handle?

Insurance policy lawyers deal with a wide range of insurance types, including health insurance, auto insurance, homeowners insurance, business insurance, and more. Our knowledge extends to various policy forms and coverages.

How Can An Insurance Policy Lawyer Help With Claim Denials?

If your insurance claim is denied, our insurance policy lawyers can review your policy, assess the denial reasons, and determine whether there are legal grounds to challenge the decision. We can then guide you through the appeals process or, if needed, pursue legal action to secure the coverage you deserve.

What Role Do Insurance Policy Lawyers Play In Litigation?

In the event of a dispute that escalates to litigation, our insurance policy lawyers will act as your legal representative. We advocate for our clients in court, presenting arguments, gathering evidence, and guiding you toward a fair resolution.

Are Insurance Policy Lawyers Involved In Insurance Fraud Cases?

Insurance policy lawyers may be involved in cases related to insurance fraud, representing either policyholders or insurers. We can investigate suspected fraud, gather evidence, and present legal arguments in court if fraud is identified.

How Do Insurance Policy Lawyers Handle Subrogation Issues?

Subrogation occurs when an insurer seeks reimbursement from a third party for a claim they have paid. Insurance policy lawyers assist in subrogation cases by pursuing legal action against responsible parties to recover funds for the insurer.

What Steps Should I Take If I Need An Insurance Policy Lawyer?

If you require the services of our insurance policy lawyers, start by gathering relevant documents, such as your insurance policy and any correspondence with the insurer. Schedule a consultation with our lawyer to discuss your case, and we can provide guidance on the best course of action.

How Are Fees Typically Structured For Insurance Policy Lawyers?

Fees for insurance policy lawyers vary, but we commonly use billing structures such as hourly rates, contingency fees, or a combination of both. It’s important to discuss fee arrangements during the initial consultation to maintain clarity and transparency.

San Francisco Insurance Policy Glossary

At The Law Office of Bennett M. Cohen, our San Francisco, CA insurance policy lawyer frequently deals with complicated legal language that can be difficult for policyholders to understand. Whether assisting clients with claims disputes, policy interpretations, or litigation against insurance companies, knowing the key legal terms in this field is essential. We define and explain at least five important legal terms that are commonly used in insurance policy law.

Indemnity

Indemnity is the principle that an insurance policyholder should be restored to their financial position before a loss, without profiting from the insurance claim. When our San Francisco insurance policy attorney assists clients with insurance claims, we make sure that their insurer upholds the principle of indemnity. This means that the insurance company should compensate the policyholder for covered losses, but only up to the actual value of the loss. If an insurer undervalues a claim or denies rightful compensation, we challenge the decision by presenting evidence of the true financial impact of the loss.

Bad Faith Insurance

Bad faith insurance refers to an insurer’s unfair or deceptive practices, such as unreasonably denying a valid claim, delaying payments, or failing to investigate a claim properly. Our bad faith insurance claims lawyer frequently deal with bad faith insurance cases where companies try to avoid paying out claims. When insurers fail to act in good faith, we hold them accountable through legal action. Our responsibility includes gathering evidence of wrongful claim denials, negotiating with insurers, and, if necessary, filing lawsuits to secure the fair compensation our clients deserve.

Policy Exclusions

Policy exclusions are specific conditions or events listed in an insurance policy that are not covered by the insurer. One of the biggest challenges our clients face is understanding what their insurance policy actually covers. Many policies contain exclusions that limit coverage for certain events, such as natural disasters, intentional acts, or pre-existing conditions. When disputes arise over whether an exclusion applies, our San Francisco insurance policy attorney carefully analyzes the policy language, applicable laws, and relevant case law to advocate for our clients and challenge unfair denials.

Declarations Page

The declarations page is the section of an insurance policy that provides a summary of the coverage, including policy limits, premiums, and the insured parties. When reviewing a client’s insurance policy, our lawyers always start with the declarations page to understand the basic details of their coverage. This page outlines key information such as coverage amounts, deductible amounts, and the specific risks covered. If an insurer tries to misinterpret or change coverage terms after a claim is filed, we use the declarations page as primary evidence of the original contract terms.

Subrogation

Subrogation is the legal right of an insurance company to recover the amount it paid on a claim from a third party that was responsible for the loss. Many clients are unaware that their insurance company may seek subrogation after paying out a claim. For example, if a client’s vehicle is damaged in a car accident due to another driver’s negligence and their insurer pays for the repairs, the insurer may pursue legal action against the at-fault driver to recover the costs. Our lawyers make certain that clients are fully informed about their rights during the subrogation process and help them avoid potential legal pitfalls, such as waiving their right to further compensation.

The Law Office of Bennett M. Cohen, San Francisco Insurance Policy Lawyer

1438 Market St, San Francisco, CA 94102

Contact Our San Francisco Insurance Policy Lawyer Today

When you’re dealing with a life insurance policy dispute, contact our attorney as soon as possible. Our San Francisco insurance policy lawyer will review your policy and claim and evaluate if you have a case as a claimant and, if so, how much you are legally entitled to. These disputes are time-sensitive, and our team is ready to go to work on your behalf.

It’s important to find representation that you can trust to advocate for you and your claim. Our team is focused, experienced, and compassionate. Contact The Law Office of Bennett M. Cohen today to schedule a free consultation and learn more about how we can help.

Meet Bennett M. Cohen

San Francisco Personal Injury Attorney

Bennett M. Cohen brings over 30 years of litigation experience which includes representing plaintiffs against massive companies like the Shell Oil Company, Standard Insurance Company, and Metropolitan Life Insurance Company. Bennett M. Cohen brings an experienced and dynamic touch that separates himself from large law firms. He can oversee every aspect of your case, ensuring you receive specialized assistance.

Learn moreDon’t Leave Your Case To Chance

Ensure your case is in the hands of a seasoned professional that will fight for you